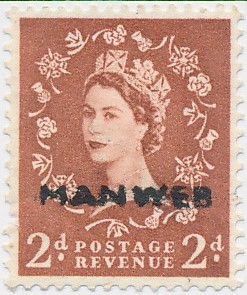

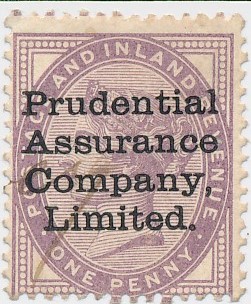

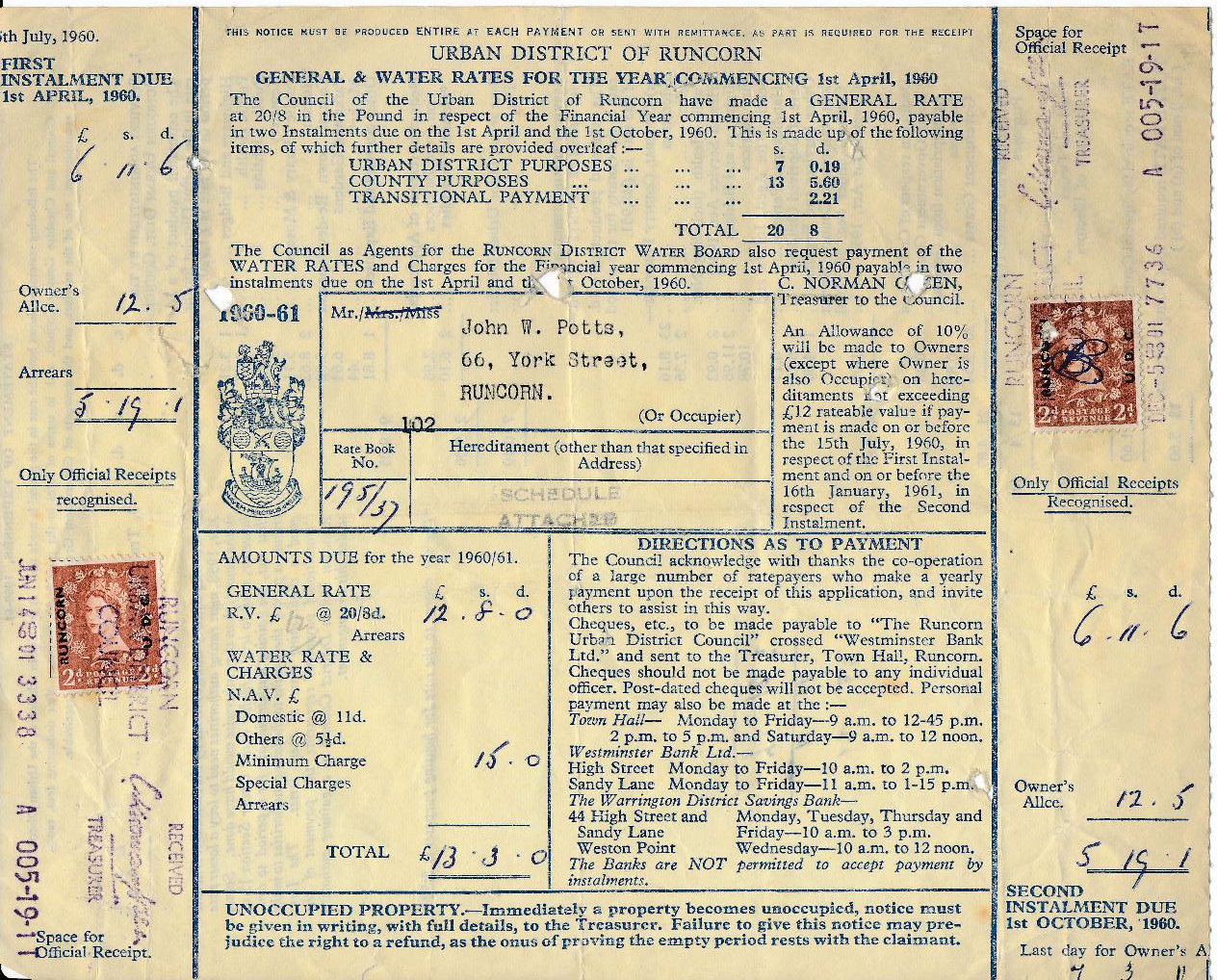

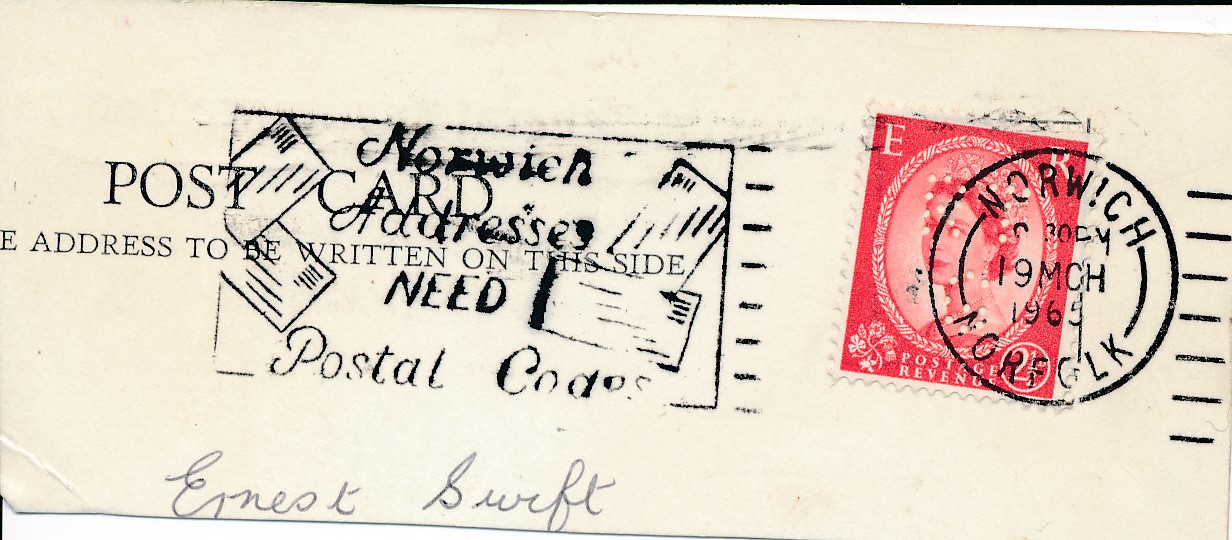

Some examples of local and well-known Postage stamp overprints and "Perfins"

"If you were born after 1971, chances are that you have never seen a receipt, with a postage stamp attached, and usually signed to say that payment has been received. If you were born before 1971, you have probably seen one, but not took any notice, as that was how they were. The reason why they were attached, was that they were 'Stamp Duty'. The requirement for putting stamps on receipts was brought in by the 1891 Stamp Act in order to raise money for the Government. The 1920 Finance Act specified that any receipt for something worth £2.00 or over should have a twopence stamp attached. On 24 January 1970 the Times had a longish piece about a Private Member's Bill to abolish it. It was still apparently due on any non-cheque receipt for more than £2, even a shop one. It was eventually the 1970 Finance Act that repealed the relevant sections 101-103 of the Stamp Act 1891. On 15 December the Times said: "The 2d. stamp duties on cheques, promissory notes and receipts are to be abolished from February 1 next year. Claims for repayment of duty on unused cheques must be made before that date." Stamp Duty still exists in the form of a levy on property sales, land transactions, share transactions etc. There was a tendency for pilfering of the stamps, as they could be used for currency. To stop this, companies, local authorities and other organisations, used two types of methods to stop this. One was overprinting the name of the company, onto all of the stamps. The other, was to perforate the initials of the company, these were known as Perfins. These practices were used by Runcorn companies and the Council, as well as the utility services, that served Runcorn and Widnes. Here are a few examples, of local overprints & perfins, as well as some well known names that will be familiar".

Carters Seeds

Lewis's Department Store

Liverpool Corporation

Merseyside and North Wales Electricity Board,

now part of Scottish Power

"The Pru" Assurance

Southport Corporation

Perforated with A and J

Perforated with BSA

Runcorn Urban District Ratesbill with Overprinted stamps

Perforated with RTS, ie Runcorn Transport Services